Personal Expenses Explained

All students need to have a budget for personal expenses such as personal items, laundry, going to the movies, or buying a pizza.

These expenses are not paid out to the college. Instead, you manage and pay for these expenses yourself as a college student. Expenses vary from one student to the next based on their particular needs and lifestyle.

For instance, if you look at transportation costs:

- Students can opt to use bikes and public transportation to get everywhere they need to go.

- Other students opt to maintain their own vehicles.

- Non-resident students usually have increased transportation expenses due to trips home during the holiday breaks.

Tip: You are the best person to estimate your college expenses. The amount that we display in the cost of attendance summary in DecidED is an average amount that you can subtract or add to based on your specific needs.

When you add a college to DecidED for the first time, personal expenses are estimated based on a student average from a prior school year.

Personal expenses are displayed under the “life budget” section of the first year breakdown in DecidED, not under your “college bill.” This is because you do not pay the estimated personal expenses to the college. These are costs that you will need to pay to yourself, which is why you must be mindful of your life budget throughout the year.

Tip: You have more control over “life budget” costs. For example, you can save money by renting or purchasing a used textbook, or getting a digital copy instead of buying a brand new textbook (usually the most expensive option).

Each college estimates personal expenses differently

Personal expenses are costs that are beyond your tuition and fees, room and board, books and supplies, and transportation.

- Personal expenses include necessities like laundry, cell phone service, clothing, personal care products, prescriptions, car insurance and registration, recreation, and more.

- Colleges estimate these personal expenses based on prior data collected by past students.

- When you budget for your personal expenses, consider that the costs will vary based on your living situation and your proximity to campus.

- To budget, be sure you consider all the possible expenses that you will need to manage. Once you know the full picture, you can get creative to eliminate or reduce your expenses.

Tip: Check out the expenses and amounts listed under “life budget” for each of your schools. These are conservative numbers that you can use to plan for the academic year. This number is not fixed so you can end up spending less or more on life budget expenses.

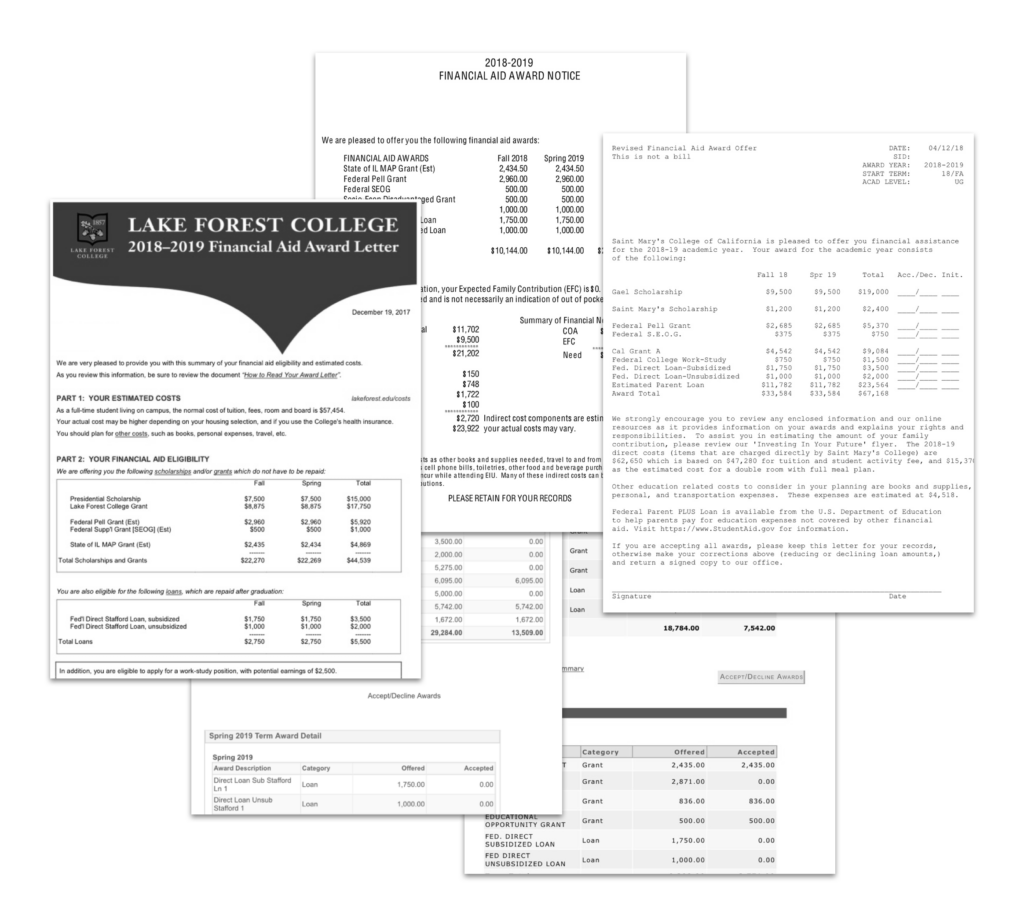

What to look for in your financial aid letter

Personal expenses are often estimated in the offer letter for all registered students as one expense line item. You may also see a personal expense referred to as “personal, miscellaneous.”

Your award letter may have a footnote or section that explains what is included in the personal expense. For example, there may be a note to clarify that personal expenses include clothing, laundry, and personal care.

You do not pay your personal expenses to your college.

- Colleges provide this estimate so that students like you can plan for a whole year of college-related expenses.

- You can use scholarships and other aid towards your personal expenses if you’ve covered your tuition and fees, room and board, books and supplies, and transportation.

Before you consider taking out loans to cover your personal expenses, be sure to apply to scholarships and consider work-study or a part-time job.

Tip: We recommend that you not work more than 20 hours per week, as this can make managing your academics challenging.If you are an international student, working more than 20 hours a week might jeopardize your immigration status. Aim to work between 10-15 hours per week.

Check out these guides for more information on Understanding College Bill and Life Budget Expenses.

How can I keep my personal expenses low?

Budgeting and controlling your spending can help you keep your personal expenses lower. Here are a few ideas for decreasing your personal expenses:

- Cut your mobile phone costs by updating to a cheaper plan.

- Find student discounts at places like CollegeBuys.org.

- Be careful of peer pressure spending. Consider a minimalist mentality by purchasing only what you need, when you need it.

- Keep applying for scholarships all throughout college! Scholarship applications open and close all year long and many can be applied to basic needs and expenses. Read more about scholarships.

Make a plan to finish college as soon as you can. The more years you stay in college, the more your expenses add up. Read more about your college’s graduation rate, which can be an indicator of how much time you could spend at your college.

Tip: If your actual expenses are significantly higher than what is listed on your financial aid award, you may be able to request an adjustment to your budget. Contact your financial aid office to see if they can adjust your budget and increase your financial aid eligibility.