FAFSA and CADAA 101

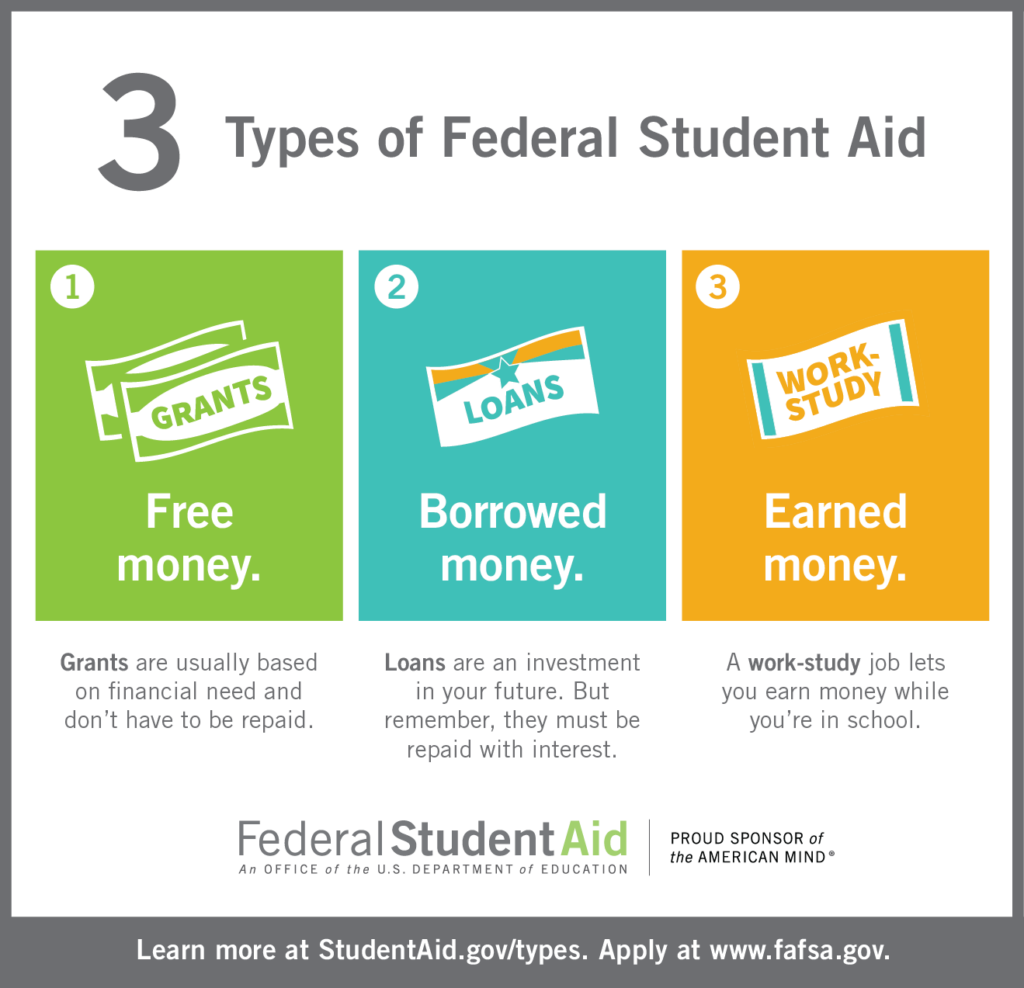

The Free Application for Federal Student Aid (FAFSA) is the application you will need to submit in order to receive federal and state aid for college. Schools use the FAFSA application to evaluate the types of financial aid you may be eligible for.

Undocumented students in California should submit The California Dream Act Application (CADAA) to get funding from the state. This application may also be applied to colleges and universities if you are eligible for AB 540.

Tip: Fill out either the FAFSA or CADAA. Do not file both. If you are not a California resident, ask your counselors or teachers if a similar application exists in your state.

Important FAFSA Dates

For students applying for financial aid for the 2024-25 academic year the FAFSA and CADAA applications will open in December 2023. CADAA has a priority deadline of April 2, 2024 for California students applying to four-year colleges.

Be sure to still submit your application even if you are planning on attending a community college so as not to miss out on potential free money that can support you and your education.

FAFSA / CADAA Preparation

Step 1: Determine which form you need to complete. You’ll need to complete the FAFSA, CADAA, or look for a different state program if you live outside California.

Step 3: Gather all of the documents you will need to complete your application.

There will be some paperwork and information you need to gather before filing your FAFSA or CADAA application. . Gathering all information beforehand can save you up to an hour on your application.

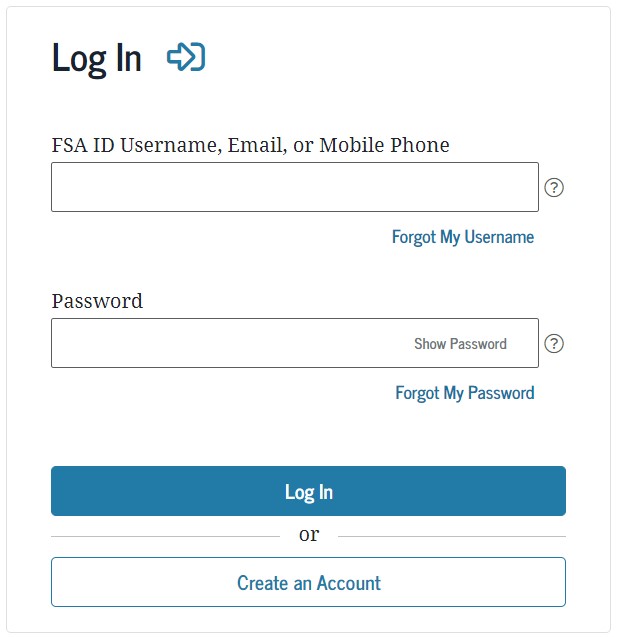

Step 2: Create your FSA ID. This step is only necessary for FAFSA. You can complete this step before FAFSA applications open.

The FSA ID is an account that you, and one of your parents/legal guardians, set up. The FSA ID is necessary to sign your FAFSA application electronically. The best thing you can do is create an FSA ID before you begin your FAFSA application.

- Check out this 5 minute video on how to set up your FSA ID

- Here’s how you can take care of any problems setting up the FSA IDs for yourself and your parent/legal guardian.

- Parents/legal guardians without a social security number (SSN) will be able to create an FSA ID when FAFSA opens in December 2023.

Tip: Be sure to use separate email addresses for you and your parent/legal guardian.

Which documents do you need?

- Social Security Number (SSN) for FAFSA

- Parent(s) SSN or Individual Taxpayer Identification Number (ITIN) if they do not have an SSN. Your parent(s) will have an ITIN if they do their taxes but do not have an SSN

Tip: You will need your parent(s) SSN or ITIN if you are a dependent student.

How do you know if you are a dependent student?

If you answer no to all of the questions in this form, then you are considered a dependent student. You will need to provide your parents’ financial information on the FAFSA.

You will also need:

- Drivers License (if you have one)

- Permanent Resident Card Number (“Green Card”, if you have one)

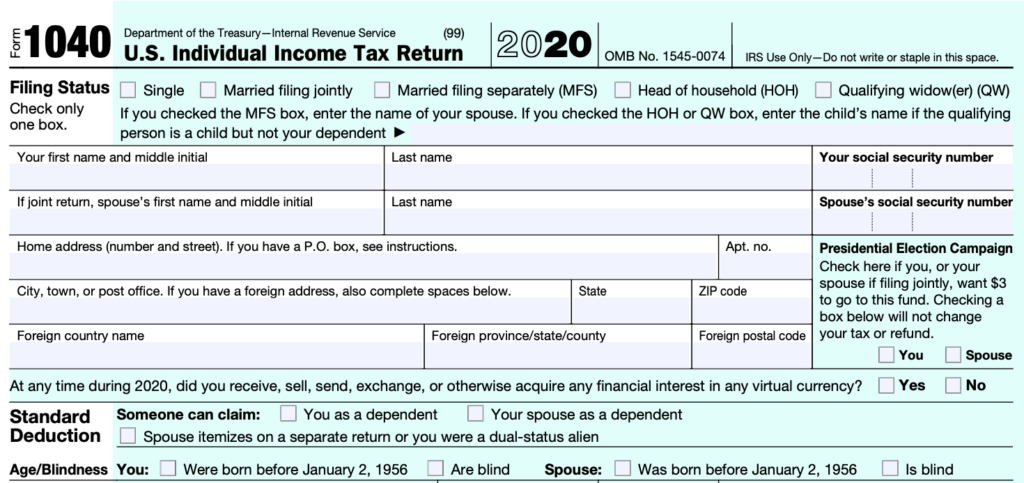

- Previous year’s Tax Records (IRS 1040) or financial records if taxes were not filed.

- Records of untaxed income for you and your parent(s) if you or your parent(s) received untaxed income. Here are some examples of untaxed income:

- Child support received

- Workers compensation or disability benefits

- Housing, food, or other living allowances paid to members of the military, clergy or others

- A list of how much you and/or your parents have in:

- Checking

- Savings

- Stocks

- Bonds

- Real Estate (does not include the house you live in)

- Business assets

- List of colleges/universities you are interested in attending

- NEW for 2024-25 applicants – students will be able to enter up to 20 colleges and universities

Example of IRS 1040

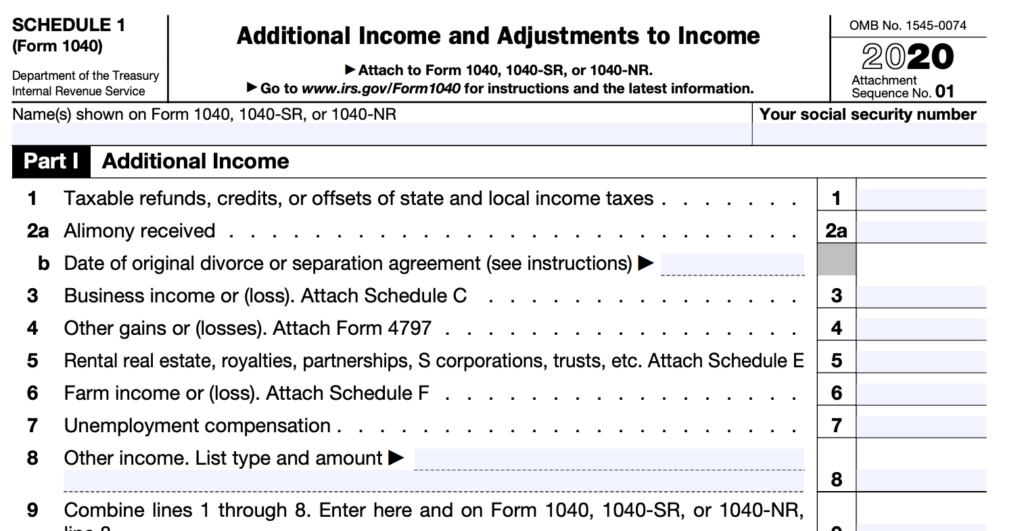

Tip: You may be asked if you filed a “schedule 1”. Not everyone has a “schedule 1”. If you don’t find it in your taxes, you did not file it. See below for an example of what the “schedule 1” looks like.

Example of Schedule 1

Keep in mind:

- FAFSA and CADAA applications are free.

- If possible, work on these applications with your parent(s) or legal guardian.

- Be sure your name matches on all records: It is very important that the name that you use for your FAFSA/CADAA matches what your school has for your name. Be careful with middle initials and last names if you have more than one.

- For example, if your name is “Amy E. Fuentes Lopez” with your school, make sure that you use that exact name with FAFSA/CADAA and not “Amy Fuentes” or a different variation.

- For those of you completing a CADAA application, you will receive a Dream Act application ID number when you create an account. It’s important that you write this application ID number down because you will need it if you need to call to ask questions about your application.

- While you’re working on the FAFSA, you will have the option to use the IRS Data Retrieval Tool. If possible, you should use this tool. Why? Because the DRT will automatically pull all of your parents’ tax information, so you won’t have to spend time filling in small tax details.

- Students or parents who are: married and filed as “Married Filing Separately,” married and filed as “Head of Household,” or who have filed an IRS Form 1040NR or 1040NR-EZ or a tax return from Puerto Rico or a foreign country, aren’t eligible to use the IRS DRT and will need to enter their tax return information manually. Also, this tool may not be available for CADAA.

Find answers to the questions below and more on the US government student aid site.

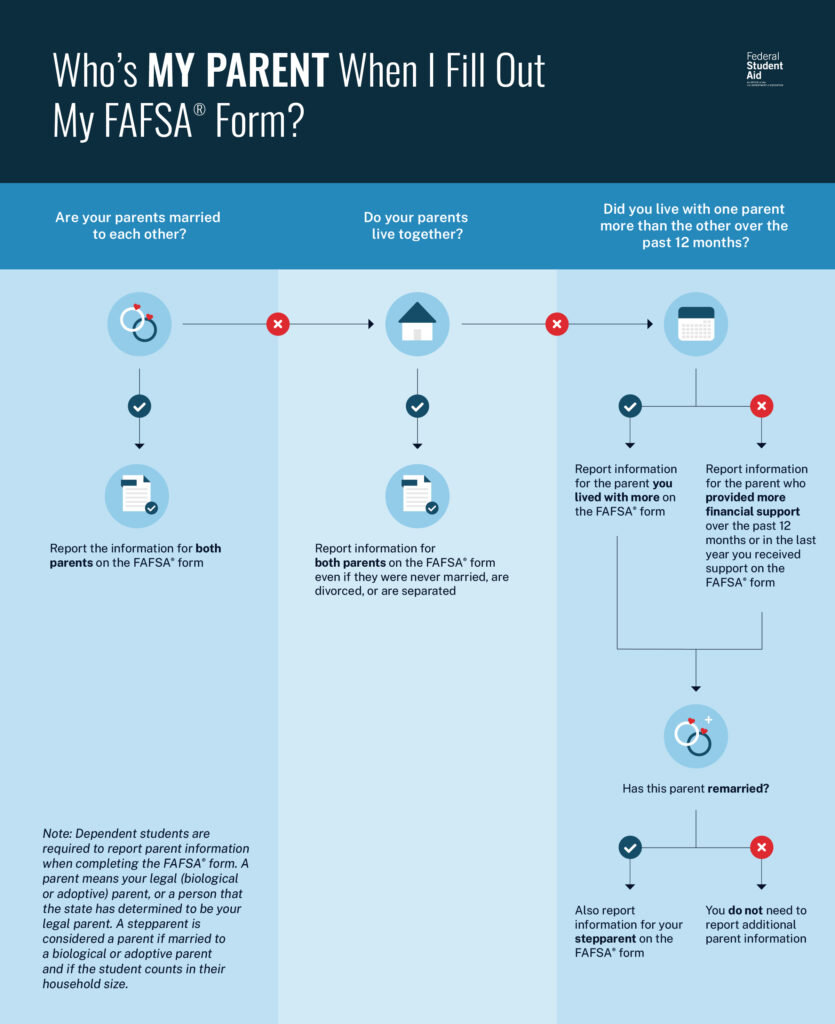

- Who counts as your parent on the FAFSA?

- What if your parents are separated or divorced?

- What if I have a step parent?

- What if my parents won’t share their tax information?